Evolution of the Value Creation Model

The approach to creating value in portfolio companies has changed significantly over the years. During the infancy of the Private Equity industry, investors had developed a somewhat unfavourable reputation amongst the business community, as infamously documented in the best selling book “Barbarians at the Gate”.

The approach to creating value in portfolio companies has changed significantly over the years. During the infancy of the Private Equity industry, investors had developed a somewhat unfavourable reputation amongst the business community, as infamously documented in the best selling book “Barbarians at the Gate”. The book provides a thrilling and comprehensive account of one of the largest public to private buyouts in the world during the LBO boom in the 80’s. The below article highlights the key changes in value creation strategy and implementation from the early days to present day, and the expected trends going forward.

The 3 key Components to Value Creation

Deleveraging – Historically this was the strategy of choice for investors, and typically involved the repayment of high levels of debt by cost cutting measures and the sale of non core assets. Therefore in order for this approach to be most advantageous, it was essential that portfolio companies had steady and stable cashflows from the onset.

Multiple Expansion – This is where the future growth profile of a portfolio company improves under PE ownership. This is typically achieved by enhancing the company strategy, lowering risk in the business model, or furthering a credible growth story. As the future growth profile of a business is also impacted by industry specific and wider economic factors, this can have an impact on future valuations.

Operational Improvement – The aim is to work with portfolio companies in order to enhance the cashflow profile of the business by improved revenue growth and improvements in operating margin, i.e grow EBITDA.

Early days – 1970 to 1990’s

Up until the mid to late 1970’s, the Private Equity community was a niche area of the finance community characterised by a handful of firms in the US (including a new start up called “KKR”). During the early days investors would create value predominantly via the use of financial engineering. The initial approach to value creation was essentially; Seeking out a poorly performing stock, taking the business private with the use of leverage, and creating value by creating a leaner and focused business, which inevitably led to cost cutting and the sale of non core assets (therefore poorly managed businesses with big balance sheets were ideal candidates). Naturally when a business was facing a potential buyout, the approach wasn’t always welcomed by management.

The “Noughties” to Present day

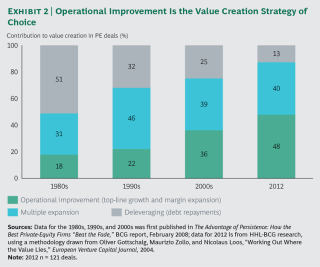

In subsequent years, the value creation model has evolved from financial engineering to a more strategic and growth focused approach. The below graph is from a study performed by BCG in 2012, illustrating the change in the value creation strategy for a sample of buyout deals across Europe. Whereas during the 80’s, just over half of the buyouts created value via deleveraging, over the next 3 decades the value creation strategy of choice has shifted in favour of operational improvements to portfolio companies. Multiple expansion has consistently remained as the superior engine of value creation.

There has been a real shift from sitting on company Boards and empowering management, to a more hands on approach whereby investors work closely with management in order to steer growth. This has led to investors developing their own best practice playbooks based on their past experiences and interactions with portfolio companies, and using these tried and tested value creation techniques across their investments in order to accelerate value. Over time PE firms have created their own standardised playbook which covers the key value creation techniques and tools to ensure optimal value is being generated throughout the lifecycle of each investment. The playbook typically covers key areas across the lifecycle of an investment such as;

– Due diligence on an investment

– How to spot the right growth opportunities

– How to gain management buy in to implement the growth plan

– Preparing an investment for a successful exit

Key levers in Operational Improvement

Operating teams have grown significantly over the last decade to reflect the shift in value creation, changing the way PE firms work with portfolio companies. Nowadays a PE firm upon investing in a business, will also bring a wealth of knowledge and skills to plug into a portfolio company from day one in order to provide all round support to the management team. This typically covers areas such as Pricing Strategy, Marketing, Digital Transformation/Data Analytics, and Merger Integration. Working alongside management, investors can focus on the following levers of operational improvement;

– Optimising sales execution capabilities

– Driving growth via new products/services, new verticals, and new geographies

– Tech enablement

– Human capital

– Improve operational effectiveness

– M&A and Carve outs

Which value creation strategy is the most beneficial?

As the focus of value creation has shifted towards operational improvements, this has had a knock on effect on deal making, and the approach used to generate value in portfolio businesses.

In particular, one of the most favoured levers being used to achieve both operational improvement and multiple expansion is “Buy and Build” M&A. Buy and Build is where a PE firm acquires a business and uses the initial deal as a platform for continued growth via bolt on acquisitions. This strategy of growing via bolt on deals allows investors to benefit from synergies therefore accelerating revenue growth, improving operating margins, and creating expectations of a platform for continued growth. Due to being able to benefit from synergies in deal making, this has allowed PE firms to better compete with Corporate buyers in the M&A market.

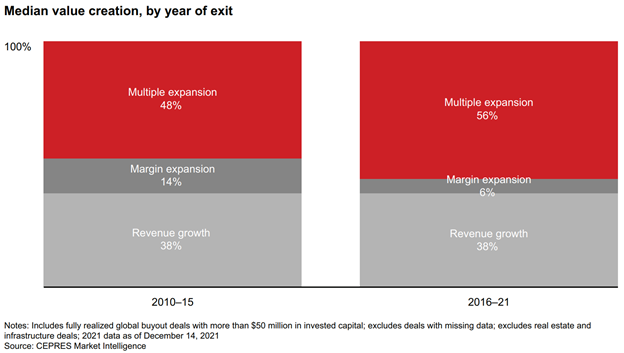

Multiple expansion creates the most value relative to other value creation levers. The value at exit is typically where investors achieve their highest returns on investment, particularly in PE deals which have involved Buy and Build. The reason why Buy and Build is such a favoured option is because they typically generate a higher IRR versus standalone deals.

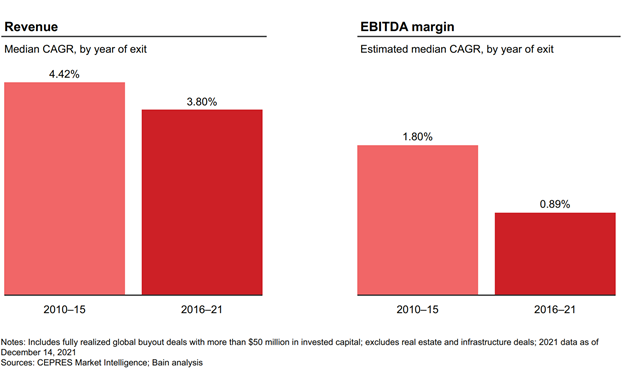

“According to CEPRES Market Intelligence, multiple expansion has been by far the largest contributor to private equity buyout returns over the past decade, dwarfing revenue growth and margin improvement as sources of value creation. Over the past five years, the trend has become even more pronounced. While multiple expansion accounted for 48% of value creation in the average deal from 2010 to 2015, that number jumped to 56% from 2016 to 2021. CEPRES data shows that revenue and margin growth among buyout companies have fallen 14% and 51%, respectively. For the past decade, then, private equity funds have not only developed an outsize reliance on multiple expansion to generate returns, but they have also lost ground when it comes to adding organic value” (Bain & Co: Global Private Equity report 2022).

Future trends

As PE firms continue to grow and invest in their operational teams, this will drive greater collaboration between management teams across portfolio investments, in areas such as Digital transformation, Supply chain, Procurement, Finance, and Sales. The expectation is there will be increased integration between Operational and Deal teams as investors use their value creation knowledge and resource as a competitive edge in buyout transactions.

ESG considerations continue to grow as a lever for risk management and growth. Investors are increasingly using ESG performance metrics as part of their deal process. It will take time for ESG to fully embed itself as an established value creation lever, due to the current challenges in measuring performance versus prescribed metrics.

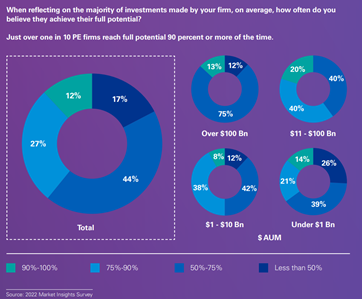

The value creation playbook will continue to evolve and improve as technology enables greater insight into customer experiences and improved insight into the key drivers of business performance. Value creation is increasingly the difference between being successful or not in a transaction. It also helps establish a route to higher realised returns. The chances of a successful investment are then magnified and less dependent on favourable market conditions or luck. At the moment, investors are having to adapt their playbook to take account of the challenges presented by an inflationary environment. According to KPMG’s 2022 Value Creation report, just over 1 in 10 PE firms reach full potential of their value creation plans, 90% or more of the time.

Summary

As the Private Equity industry has developed over the years, this has led to increasing challenges in terms of value creation in portfolio companies. As the amount of capital being poured into the industry creates increased competition for attractive investments, there is also a heightened focus on ensuring optimal value can be generated to maintain high returns. As the focus of PE firms has shifted to working closely with portfolio companies, this has created the need for the recruitment of larger operating teams with a diverse skill set covering the growing list of value creation levers. This has led to management teams increasingly preferring a partnership with Private Equity, as they welcome the active support investors can provide to adding value.

Investors are also paying close attention to what may disrupt their value creations plans in order to avoid blind spots. This requires robust modelling to ensure downside scenarios are tested rigorously, as well as proactively being prepared for additional challenges such as inflation, rising valuations, digital disruption, talent shortages, and supply chain issues. The sooner this is done during the deal process, enables investors and management teams to proactively manage risks and take advantage of growth opportunities.